Dear Walmart Stock Fans, Mark Your Calendars for August 21

In a market where flashy tech names often dominate investor attention, it’s easy to overlook the quiet strength of a company like Walmart (WMT). For more than half a century, this retail giant has delivered steady growth, rising from its roots in rural Arkansas to become one of the world’s largest and most reliable businesses. With a recession-resistant model and a long history of increasing dividends, Walmart has rewarded patient investors through all kinds of market cycles.

While the company may not grab headlines as often as Silicon Valley giants, Walmart’s consistency has made it a long-term winner, frequently outpacing the broader market. Now, as the company gears up to report its second-quarter earnings later this month, it’s the perfect time to take a fresh look at this retail legend.

About Walmart Stock

Retail giant Walmart operates at the intersection of people and technology, delivering a seamless shopping experience across stores, websites, and mobile devices. With a presence in 19 countries and over 10,750 stores worldwide, the company connects with millions and millions of customers every week. Walmart’s market capitalization currently stands at about $786 billion.

The company’s long-term track record speaks for itself. Over the past decade, Walmart stock has quietly outperformed, climbing a remarkable 356%, easily topping the broader S&P 500 Index’s ($SPX) 216% gain in the same period. Even in 2025, despite concerns around tariffs and pricing pressures weighing on consumer spending, Walmart has managed to hold its ground. The stock is up a modest 9% year-to-date (YTD), edging out the broader index’s 6% rise.

Walmart has earned its place among the elite Dividend Kings, with an exceptional 52-year streak of consecutive dividend increases, proof of its unwavering commitment to shareholders. For income-focused investors, such reliability is hard to ignore. The retail giant currently offers a forward annualized dividend of $0.94 per share, yielding 0.95%.

While the yield may not turn heads, Walmart’s conservative payout ratio of just 34% leaves ample room for future increases, making it a steady and dependable source of growing income over time.

Walmart’s Q1 Earnings Snapshot

Walmart’s fiscal 2026 first-quarter earnings, released on May 15, delivered a mixed performance that still carried some bright spots. Total revenue came in at $165.6 billion, up 2.5% year-over-year (YOY) but just shy of Wall Street’s expectations. Still, the bottom line told a more encouraging story. Adjusted earnings per share came in at $0.61, a 1.7% annual increase that topped analyst expectations by a solid 7% margin.

Drilling down into the segments, Walmart U.S. continued to anchor growth with $112.2 billion in sales, a 3.2% increase from the prior year. Sam’s Club U.S. followed closely with a 3% uptick to $22.1 billion, while international sales held steady at $29.8 billion. Same-store sales, a key retail metric, painted an encouraging picture, rising 4.5% for Walmart U.S. and 6.7% for Sam’s Club, excluding fuel.

Walmart’s online business continues to shine, delivering impressive gains across the board. In Q1, U.S. e-commerce sales climbed 21%. Sam’s Club U.S. saw a 27% spike, while international e-commerce rose 20%. Altogether, global e-commerce jumped 22%, driven by solid growth across all segments, strong demand for pickup and delivery, and the rising popularity of Walmart’s third-party marketplace.

Dear Walmart Fans, Circle Your Calendars for August 21

The retail giant is witnessing a shift in its customer base, with an increasing number of high-income shoppers opting to shop at the retailer, especially online, as it expands its digital offerings and updates its stores. During the recent earnings call, executives sounded optimistic, pointing out that Walmart has historically gained market share during economic downturns and emerged stronger on the other side. That kind of resilience remains a defining trait for the company.

Still, management acknowledged some near-term challenges. CFO John David Rainey flagged the risk of sharply higher tariffs, warning they could put pressure on Walmart’s ability to grow earnings on a YOY basis. The possibility of fast-moving price hikes adds a layer of uncertainty to what’s already a volatile economic backdrop.

As Walmart gears up to report its Q2 results before the bell on Aug. 21, the company expects net sales growth of 3.5% to 4.5%, with a modest 20-basis-point (bps) boost from the VIZIO acquisition. However, due to the unpredictable nature of U.S. trade policy, Walmart has opted not to issue guidance for EPS or operating income, highlighting the fluid environment it continues to navigate.

Still, analysts are staying upbeat. Wall Street is calling for a 7.5% YOY increase in Q2 earnings, with consensus estimates pointing to $0.72 per share. Over the longer term, analysts see a steady climb for Walmart’s earnings. EPS is expected to rise 3.6% YOY to $2.60 in fiscal 2026, followed by an even stronger 11.5% jump to $2.90 in fiscal 2027.

What Do Analysts Think About Walmart Stock?

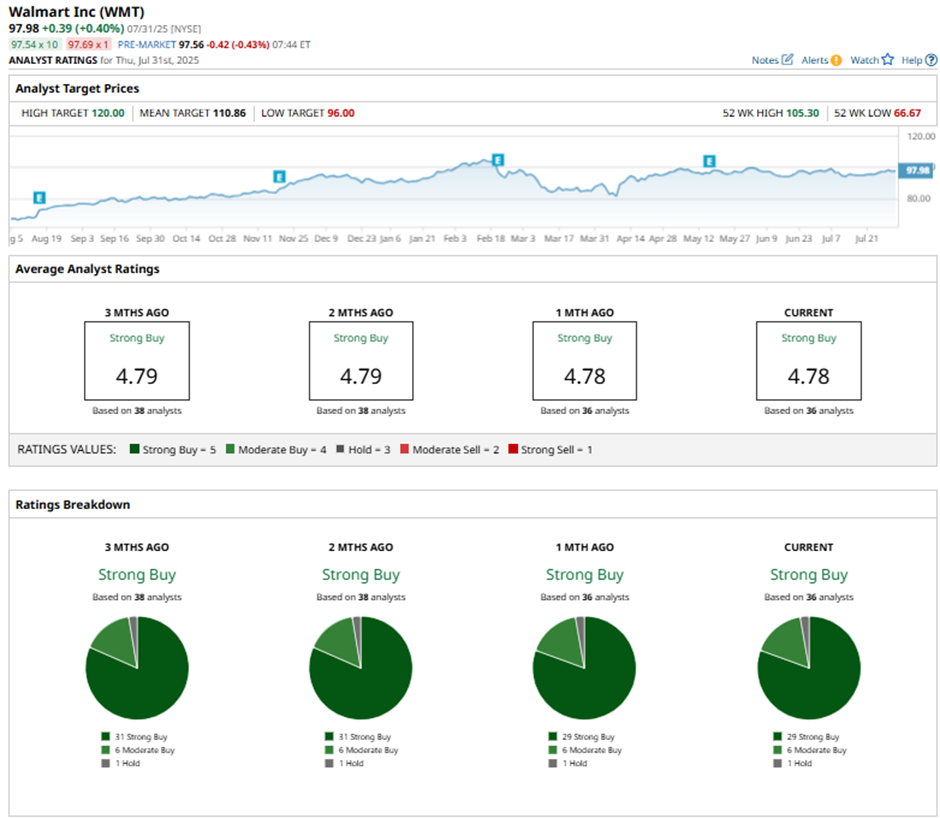

Despite uncertainties tied to fluctuating U.S. tariff policies, as anticipation builds for Walmart’s Q2 earnings, bullish sentiment is running high across Wall Street. WMT stock earns a “Strong Buy” consensus rating overall. Of the 36 analysts covering WMT, a majority of 29 back it with a “Strong Buy" rating, six rate it a “Moderate Buy,” and the remaining analyst suggests a “Hold" rating.

Walmart stock's average analyst price target of $110.86 indicates 12.5% potential upside from current levels. Meanwhile, the Street-high target of $120 suggests that shares can rally as much as 22% from here.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.